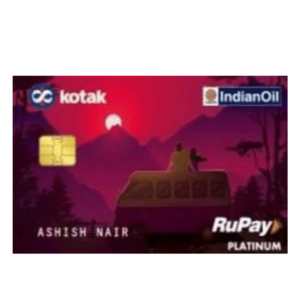

KOTAK IOCL CREDIT CARD

Kotak Mahindra Bank and Indian Oil have joined hands to introduce their co-branded credit card, the Kotak IOCL Credit Card. This card is an excellent choice for first-time credit card users who want fuel-based offers and benefits. With an annual fee of Rs. 449, it offers up to 4% value back in the form of reward points on Indian Oil fuel stations, dining, groceries, and other retail transactions. If you frequently use Indian Oil petrol pumps, this card can be highly rewarding for you.

FEATURE OF KOTAK IOCL CREDIT CARD :

-

Welcome benefit:

1,000 reward points on spending Rs.500 within 30 days of card setup.

-

Grocery and dining:

Earn 12 reward points on every Rs.150 spent on grocery and dining.

-

Fuel purchases:

Get 24 reward points on each Rs.150 spent on fuel at Indian Oil fuel stations.

-

Other transactions:

Earn three reward points on every Rs.150 spent on other transactions.

-

Annual fee waiver:

Enjoy the annual fee waiver by making transactions of at least Rs.50,000 in the previous financial year.

-

RuPay contactless payment:

Use contactless payments for transactions up to Rs.5,000.

-

Fuel surcharge waiver:

Get a fuel surcharge waiver of up to 1% with a maximum of Rs.100 per month.

ELIGIBILITY CRITERIA FOR KOTAK IOCL CREDIT CARD :

- An applicant should be the resident of India.

- He or she should be between 18 years to 65 years of age.

- An individual should have a stable income source.

DOCUMENT REQUIRED FOR KOTAK IOCL CREDIT CARD :

- Identity Proof: PAN Card, Aadhar card, driving license, Voter ID, etc.

- Income Proof: Form 16, Latest three salary slips, Income Tax Return (ITR) File, and recent bank statement.

- Address Proof: Ration card, utility bills, rent agreement, passport, etc.

WHY CHOOSE FAYDA PAY FOR KOTAK IOCL CREDIT CARD :

-

Financial Inclusion:

We are committed to bringing financial services, , to rural areas, empowering local shop retailers and individuals with earning opportunities.

-

Easy Application:

Our seamless and user-friendly application process ensures a hassle-free experience in getting the Credit Card.

-

Rewarding Benefits:

With Fayda Pay, you can maximize the rewards and benefits offered by the Credit Card, making your purchases even more rewarding.

-

Dedicated Support:

We provide dedicated customer support to assist you at every step of the way, ensuring a smooth and satisfying credit card experience.

-

Trustworthy Partner:

As an authorized provider of Credit Card services, we guarantee a secure and trustworthy transaction environment.

-

Financial Empowerment:

Fayda Pay aims to empower individuals with better financial opportunities, and the Credit Card is a step towards achieving that goal.

-

Local Presence:

With a strong presence in rural areas, we understand the unique needs and challenges of our customers, making us the ideal choice for Credit Card services.

FAQ

What is the Kotak IOCL Credit Card?

The Kotak IOCL Credit Card is a co-branded credit card offered by Kotak Mahindra Bank in collaboration with Indian Oil Corporation Limited. It is designed to provide fuel-based offers and rewards to customers.

What are the eligibility criteria for the Kotak IOCL Credit Card?

To be eligible, you should be a resident of India, aged between 18 to 65 years, and have a stable source of income.

How long does it take to get the Kotak IOCL Credit Card approved?

The approval process may vary, but typically it takes a few business days after submitting the application and required documents.

Can I get a fuel surcharge waiver with the Kotak IOCL Credit Card?

Yes, the card offers a fuel surcharge waiver of up to 1% on fuel transactions at Indian Oil fuel stations, with a maximum of Rs. 100 each month.

Is the Kotak IOCL Credit Card accepted globally?

Yes, the Kotak IOCL Credit Card is accepted globally, and you can use it at any merchant outlet that accepts Visa or Mastercard.